The stock market can be cheerful as well as sometimes frigheting to new traders/investors. However, it’s important to learn the basics of trading before you get involved in the markets. Trading can be incredibly profitable if you know what you’re doing. Different markets and strategies require different types of traders, so it’s important to know what your strengths are and which type of trading you’re suited for. Each type of trading has its own features, advantages and disadvantages like time frame, capital requirement, tax implications etc. If you don’t do your research and learn about the different types of trading, you may end up making insufficient decisions and suffering losses. Mastering one type out of different types of trading is important, but a person also need to learn others. Here’s a look at 5 of the most common types of trading in the financial world today.

1) Intraday Trading

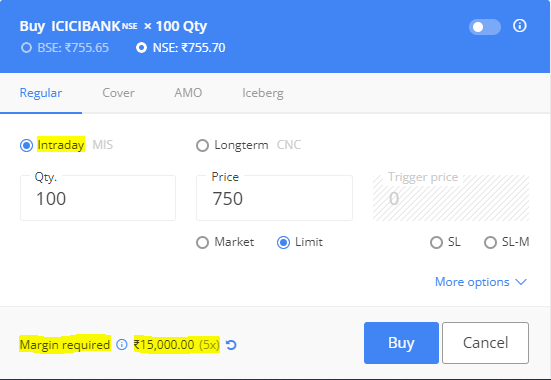

If a trader buys and sells stocks or F&O positions within the same day, it is called intraday trading. It is also called ‘Day Trading’. It means that if a trader buys the shares, he/she must have to sell it by the end of day, before the market closes. If you fail to do it, the broker will square off your position or it may get automatically squared off at the market closing price. A person has to choose an ‘Intraday’ option on the broker’s platform while trading. In this type of trading, a trader can use margin which is a credit or leverage provided by the respective broker.

| Example: Shubham wants to trade in ICICI Bank stock. The stock’s current market price is Rs.750 but he has a limited capital of Rs.15000, so he can buy only 20 shares. However with the intraday option, he can buy 100 shares as the broker is providing a 5X (5 times) margin on his capital. So if stock’s price up by Rs.10, he will earn Rs.1000 (100*10) profit. |

2) Scalping

In Scalping trading, a person trades and makes profit on the small changes in the price of stocks or F&O. A person who uses this strategy is known as Scalpler. These scalpers usually take 5 to 100 trades in a single day. The scalping uses larger positions for smaller price changes. The time of scalping can vary from seconds to minutes, and can extend it to several hours. However, the position has to square off before the market closes. This strategy is highly dependent on technical analysis, such as candlestick charts, moving averages and indicators like RSI. Many small profits can easily compound into larger gains with a strict stop-loss or exit strategy to prevent large losses.

| Example: Anuj is a scalper whose capital is around Rs.25,000 usually trades in Banknifty options. The lot size for the Banknifty option is 25. Let’s assume, the premium for the option is around Rs.100. So, Anuj buys 10 lots which is 250 quantities of Banknifty options. As discussed in the previous blog, F&O are very volatile. So, he will buy an option at a premium of Rs.100 & sell it at Rs.101. With that Rs.1 movement he earns Rs.250. If he takes 10 trades for the day, he will earn the profit of upto Rs.2000, excluding brokerages and taxes. |

3) Delivery Trading

It is also known as ‘Long Term Investing’. Delivery trading is the safest way to invest in the stock market. The investors purchase and hold stocks for a longer period of time. It also includes other assets like commodities, bonds, mutual funds etc. Investors get the benefits like share price appreciation, dividends, voting rights etc. over a longer period of time. When an investor buys stock for delivery, he gets the possession of it in his demat account & becomes the shareholder of the company. Unlike intraday, the trader does not get the margin as he has to pay the complete amount of the transaction.

| Example: Prashant has got the allotment of 40 IRCTC shares @ 300 each in IPO. On listing day, the stock’s price doubled to Rs.600. But he is a long term investor and holds stocks. After 3 years, the stock price jumped to Rs.6000 as he got 20X or 2000% returns on his investment within 3 years. |

4) Swing Trading

It is a type of momentum trading where a person trades on the changes or swings in price of stocks. In swing trading, a person buys and sells stocks or other assets for a specific duration like more than 1 day to several weeks & exit soon thereafter. For this type of trading, the trader needs to understand the price trends in the market. The important key to successful swing trading is picking up the right stock which is volatile and liquid. Swing trading relies on technical analysis, so a trader must have an understanding of price movement, volumes, moving averages etc.

| Example: Tushar has bought 50 shares of Infosys at Rs.1,500 each with a view of profit of its result. Before results were declared, stock price went to Rs. 1,600 on expectations. After declaring good results, stocks see a profit booking and stock price goes down to Rs.1,570. So, he sells stock @ Rs.1,570 & booked a profit of Rs. 3,500. |

5) Positional Trading

In this type of trading, a person takes an investment call on ‘Buy & Hold Strategy”. It ignores short term price movement and focuses in the long term. A person may buy and sell for a period of months to some years & exit soon thereafter. For successful positional trading, a person must have an understanding of fundamental analysis, different ratios, future growth, competition, various statements, etc.

| Example: In 2013, Nilesh bought 100 shares of Indiabulls Housing Finance at Rs.200 each with a view of investment for 10 years. The company shows good results & growth over the years & stock price went to Rs. 1,200 in 2018. But due to allegations on promoters, the stock price declined to Rs.900 in 2019, So Nilesh sold his investment at this price and invested it into another fundamentally sound company. |

Lastly, opening a demat account for trading & investing is quick and simple. You can open Free Demat a/c here in less than 24 hours and start your finaincial journey.

what do you think about people take position as swing trade but if market reverse they make it long term ?

clear question is “how to stop jumping between swing to long term and vice versa, which is common mindset of all “traders” ( not investors)

The main reason behind this is Psychology. Traders don’t follow trading rules of target price and stop loss. If stock price increased beyond their target, they become greedy and if price decreased below their buying price, they didn’t put stop loss and hold stock for longer term. So the solution is traders should strictly follow trading rules of target and stop loss. For investors, they should research on company’s fundamentals, growth, earnings, management etc. and hold them according to their investment horizon.