In previous post, we have seen Basics of Mutual Funds. Investors use mutual funds to minimize their risk by investing in diversified portfolio of stocks in different sectors. It is less risky than holding individual stocks. Investing in stocks requires well knowledge & large capital while mutual fund requires smaller capital & less expertise. In addition, mutual fund managers buy and sell securities, so investors need not to worry about transaction costs or brokerage.

Mutual Fund Objectives

1) Capital Protection – Mutual fund collects money from investors & invest it into different securities like Government Bonds, Treasury Bills, Blue-Chip companies’ stocks. Also, SEBI is there to protect the investors. Therefore, it involves very low risk and safety of capital.

2) Steady Income – Mutual funds invest in Corporate Bonds, Government bonds, Certificate of Deposits, Dividend paying stocks. As a result, investors get steady income in the form of interest and dividend. However, it totally depends upon companies’ performance (Dividend) and interest rates (Interest).

3) Growth – Most mutual fund schemes invest in equity shares and sometimes preference shares. It carries a higher risk but provide better returns than income funds. This is the best option for hedging against inflation. Investments in mutual funds grows exponentially over a period of years.

4) Liquidity – Previously we have discussed that SIP is like Recurring Deposit (RD) in bank. However, there is a major difference between SIP and RD in case of liquidity. In RD, fixed amount needs to invest for specific period. In SIP, you can redeem funds on very next day.

Mutual Fund in Goal Planning

Many people don’t follow structure approach in savings and investments. Everyone has different financial goals in life. Some goals are individual (vacations, buying a car/bike, home purchase) while others are family (children higher education, children marriage, retirement). These goals maybe short-term, medium-term or long-term.

You need to calculate how much money is required for specific goal, how much you should save every month and where to invest it to achieve goals. These goals can be achieved with the help of mutual funds.

How Much You Need to Save?

a) Let us assume your child is 10 years old and you want him/her to study for engineering. The current cost of education is around Rs.10 Lakh in private college. If education inflation is 10%, you need to accumulate about Rs.26 Lakh when he/she is ready to college. Assume 12% return on investment, you need to invest around Rs.11,500 in Equity mutual fund every month to meet education goal.

b) Suppose you want to purchase house of Rs.40 Lakh in 5 years. For down payment of Rs.5 Lakh, you need to invest Rs.6,600 every month in Debt mutual funds with estimated ROI at 9%.

Types of Mutual Funds

A) Equity: These funds primarily invest into shares/stocks of different companies. Equity mutual fund scheme have a minimum of 65% assets invested in equity shares of companies. The gain and loss depend on how shares involved in scheme performs in stock market. Only equity funds have potential to generate significant returns over the period of years. But remember higher the returns, higher the risk.

B) Debt: Debt fund schemes have less than 65% assets invested in equity. Money is collected from investors and invested in securities like Commercial Papers, Government Securities, Gilt funds, Bonds etc. The returns are not affected by fluctuation in stock market. It is a great option who are looking for passive income i.e., interest and capital appreciation with minimum risk.

C) Hybrid/Balance: It is a combination of both equity and debt investment. Its objective is to diversity the portfolio with minimum risk involved. It has potential to generate better returns than debt funds. The fund manager re-balance the fund accordingly with the market conditions.

D) Money Market Funds: It collect money from investor and invest it in short-term debt instruments, cash and equivalents with high rated quality. It is considered as safe or investment with low risk. These funds offer a predictable risk-free return. Investments include Certificate of Deposits, Commercial Papers, Treasury Bills, Re-Purchase Agreements etc.

How to Invest?

i) Branch Visit: You can visit the respective mutual fund company branch and fill the form. You can also download form from website, fill it carefully and hand over with cheque.

ii) Online Platform: There are many online platforms which you can start SIP in mutual fund. You only need PAN card details, KYC documents and bank a/c details to link with mutual fund house.

iii) Demat A/c: If you have a demat account, it can also be used for transacting in mutual fund. For this, your stockbroker need to be register as mutual fund distributor.

iv) Karvy & CAMS: You can also invest through registrars like Karvy and CAMS. This can be done online as well as offline. Online can be done by visiting website, creating an account, selecting scheme and by making payment. In offline, you can visit the local office, fill application form, hand over cancelled cheque and KYC documents.

v) Agents: Sometimes, it is time consuming and also, some agent may charge commission. But if agent is genuine, he/she will help in choosing appropriate scheme. He will get commission of 0.5-1%, but it will result into better returns over a period.

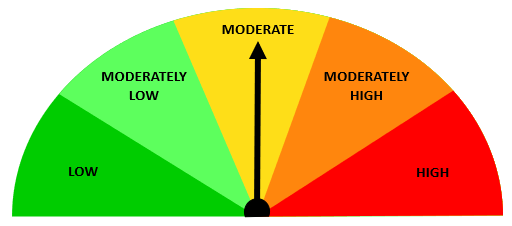

Mutual Fund Risk-O-Meter

| Risk Level | Color | Products | Suitability |

| Low | Green | Income Funds, Liquid Funds | Risk -averse investors |

| Moderately Low | Light Green | Short-Term & Medium-Term Bonds | Investors with Nominal Risk & Safety of Investment |

| Moderate | Yellow | Debt Funds, Arbitrage Funds | Investors ready to take certain degree of risk for slightly Better Returns |

| Moderately High | Orange | Equity funds, Balance Funds | Long term investors with Moderate Risk |

| High | Red | Small Cap Funds, International Funds | Aggressive Investors |

Many investors follow ‘100 minus age’ while investing. It says that you should invest a percentage in equity equal to 100 minus your age. For e.g., if your age is 30, then you should invest 70% of your investment amount in stocks or equity mutual funds. The remaining 30% should include Debt or debt funds. Despite this, everyone should know their risk profile and invest accordingly.

Disclaimer: Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Good info

Thanks for the several tips contributed on this website. I have noticed that many insurers offer buyers generous discount rates if they prefer to insure a couple of cars with them. A significant quantity of households possess several vehicles these days, particularly people with mature teenage kids still dwelling at home, as well as savings on policies might soon begin. So it makes sense to look for a great deal.

It抯 really a nice and useful piece of information. I am happy that you just shared this useful info with us. Please stay us informed like this. Thanks for sharing.

Hello! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new posts.

Hi Lieselotte, I am glad that you are enjoying my blogs. Currently, we don’t have a Twitter account. But in near future, we will definitely be on it. Till then you can read upcoming blogs here.

My brother recommended I would possibly like this website. He used to be entirely right. This publish actually made my day. You can not believe just how much time I had spent for this info! Thanks!

Thank You!